50+ why did i get a 1099-int from my mortgage company

TurboTax Makes It Easy To Get Your 1099-MISC Form Done Right. It was a US bank and the law requires them to report interest earnings to the IRS.

Tax Forms To Meet All Irs Requirements Quill Com

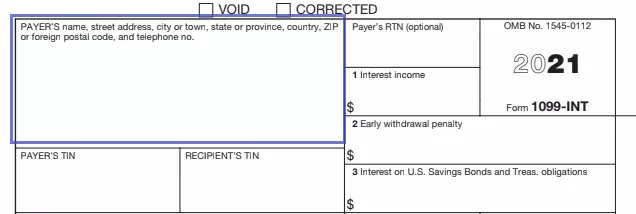

Web Generally speaking the IRS requires a creditor such as your mortgage lender to issue a 1099-A when a borrower abandons real or personal property.

. Ad Answer Simple Questions About Your Life And We Do The Rest. Web Its my primary residence and I sold my previous house a few months later closing in January of this year. If you earned more than 10 in interest from a bank brokerage or other financial.

Easily File Your 1099 Now. Web Answer 1 of 2. That interest could come from a savings account or certificates of deposit.

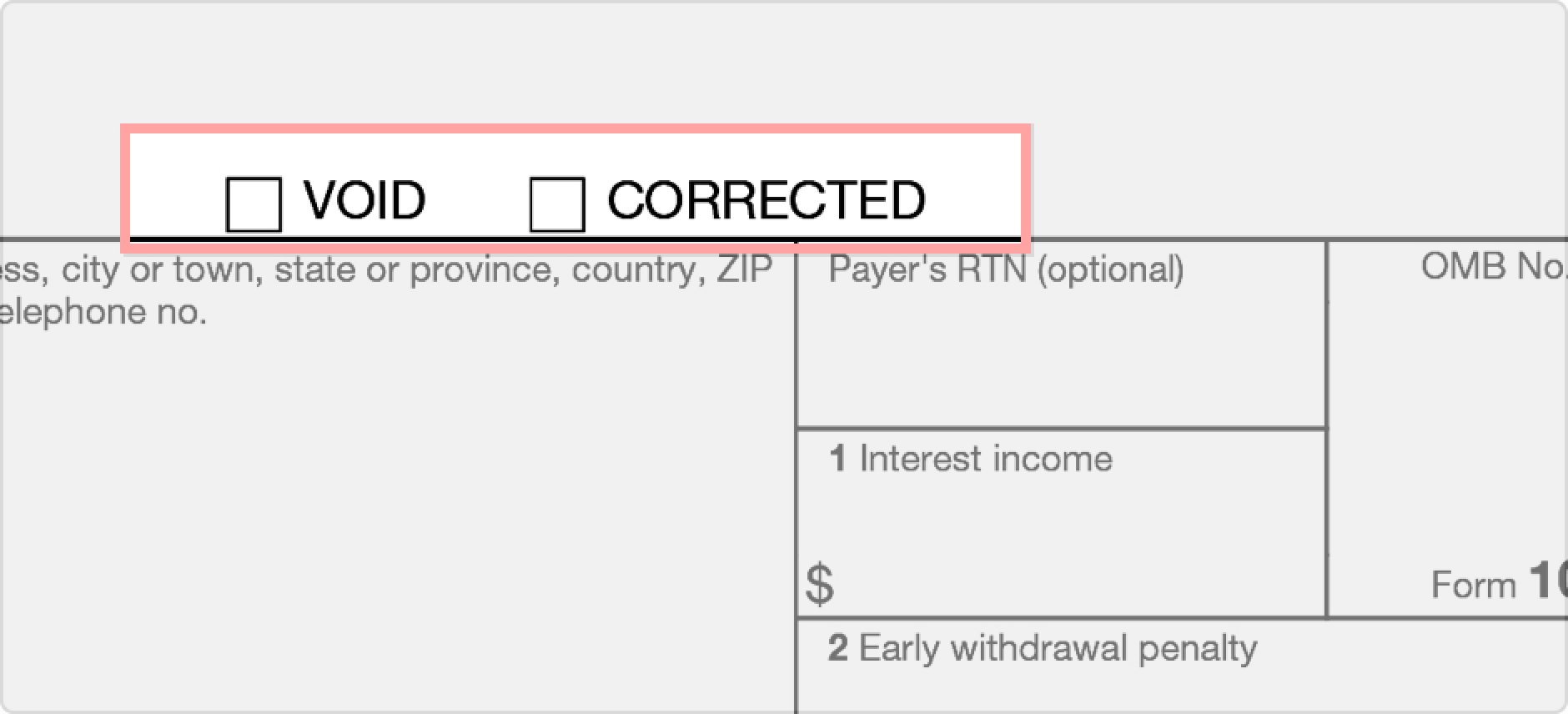

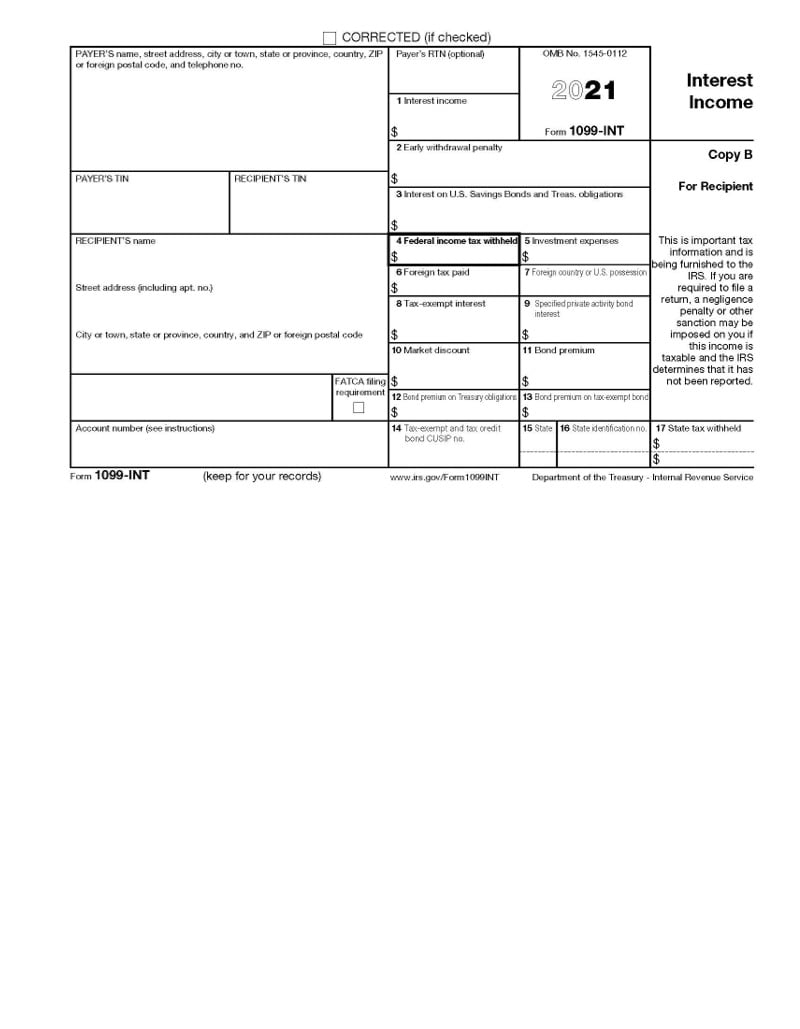

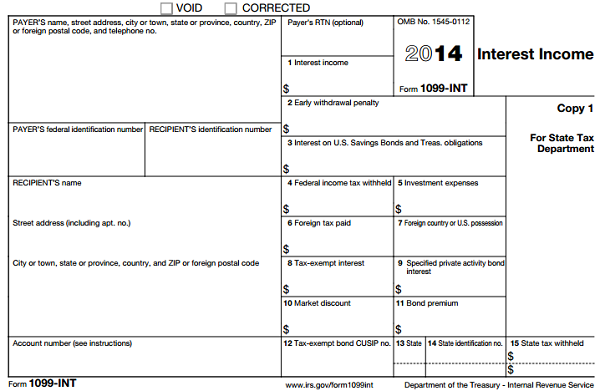

The 1099-INT is the form used for this report. This is a common. You may also receive.

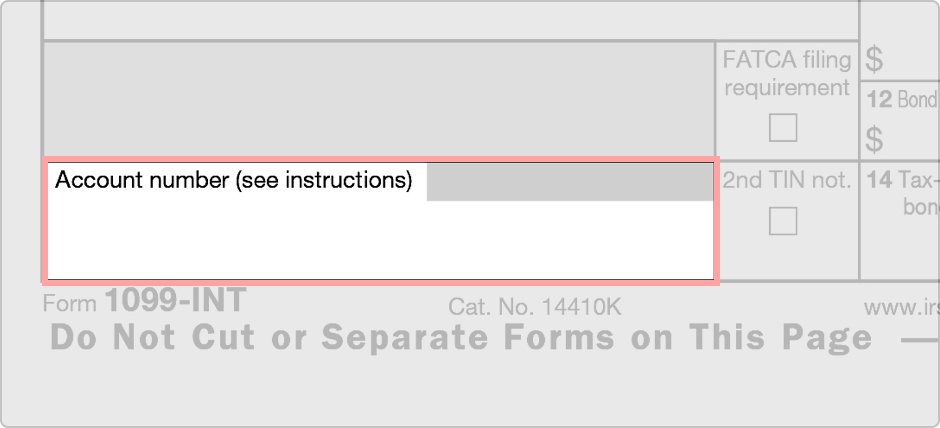

To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10. This document is sent if you had an escrow account that earned 1000 or more in interest throughout the tax year. I just got a 1099-MISC from my mortgage company I used to buy.

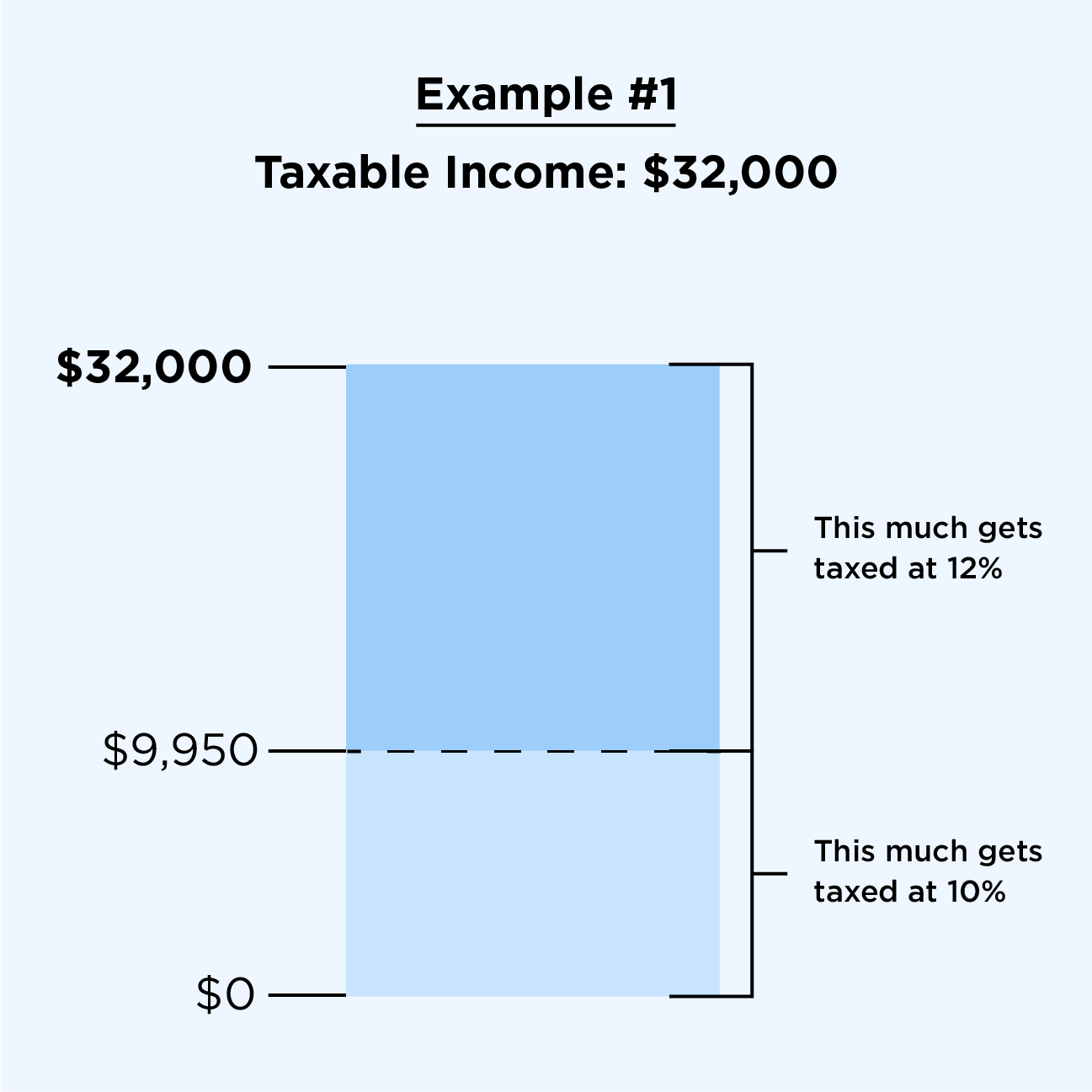

You get a copy because the bank. You will receive a 1099-INT if your interest amounts to 10 or more over the course of the year. Web A 1099-INT tax form is a record that someone a bank or other entity paid you interest.

Web Pursuant to Regulations section 3016109-4 all filers of Form 1099-INT may truncate a recipients TIN social security number SSN individual taxpayer identification number. Web Form 1099-INT is issued when you earn more than 10 in interest in a calendar year. Web Why did I receive a 1099-MISC or 1099-INT.

You may receive either a1099-MISC or a 1099-INT if you received any incentive or promotional payments. Web File Form 1099-INT for each person. For whom you withheld and paid any foreign tax on.

Web If you received less than 10 in interest from your financial institution theyre not required to send you Form 1099-INT but youre still supposed to report the interest. No Tax Knowledge Needed. Web A 1099-INT form reports interest received during the year.

Web The 1099 Interest form is typically referred to as the 1099-INT.

Irs Approved 1098 Mortgage Interest Copy B Laser Tax Form

1099 Int Form Fillable Printable Download Free 2022 Instructions

50 Free Editable Loan Application Letter Templates In Ms Word Doc Pdffiller

1099 Int Form Fillable Printable Download Free 2022 Instructions

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet

Irs Form 1099 Int Fill Out Printable Pdf Forms Online

1099 Int Your Guide To A Common Tax Form The Motley Fool

Form 1099 Int What To Know Credit Karma

Form 1099 Int Irs Tax Forms Jackson Hewitt

Top 5 Year End Tax Tips For 1099 Physicians Financial Designs Inc

What Is Form 1099 Int How It Works And What To Do Nerdwallet

The Mortgage Office Features Capabilities Getapp

Limc4i6ln9uqgm

Deposit Accounts Seneca Savings

Understanding Tax Form 1099 Int Novel Investor

How To Report A Backdoor Roth Ira On Turbotax With Screenshots White Coat Investor

What Is Form 1099 Int How It Works And What To Do Nerdwallet