Historical compound interest calculator

The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. The procedure to use the compound interest calculator is as follows.

Historical Investment Calculator Financial Calculators Com

Meeting your long-term investment goal is dependent on a number of factors.

. It is easy to use this RPI calculator all you need to do is the following. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Your estimated annual interest rate.

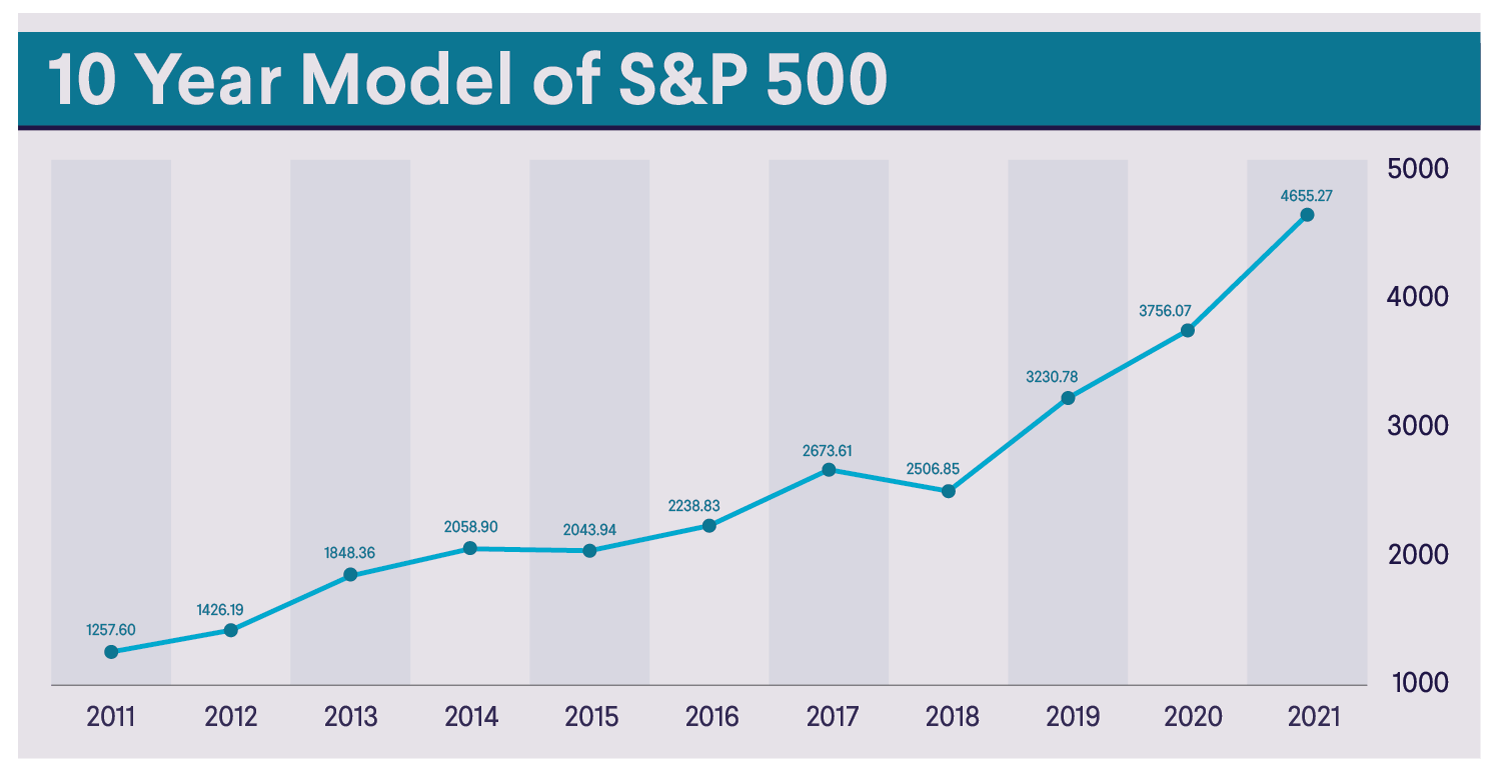

Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an effective strategy to accumulate wealth. The SP 500 History Calculator lets you compare time periods. She retires at the age of 67 so the total amount of years of growth is 37.

There are three alternative investments you can. Even small deposits to a. This not only includes your investment capital and rate of return but inflation taxes and your.

The inflation is about 2. Select a start date and input the year and the month you wish the calculator to run the calculations from. Interest rate variance range.

Compound Interest Calc uses a predictive formula to compute the future value of your money. Also see our CAPEShiller PE calculator for valuation. This calculator computes how much an amount saved in an initial year grows depending on the type of financial investment or asset chosen.

For all our calculators go to this page. Range of interest rates above and below the rate set above that you desire to see results for. Use the compound interest calculator to see the effects of compounding and interest rates on a savings plan.

Thus the interest of the second year would come out to. For instance if you. Enter the principal amount interest rate and number of years in the respective input field.

The average return on investment is around 8. According to this compound interest. To get the actual rate of interest sometimes referred to as the composite or earnings rate we combine the fixed rate and the inflation rate using the equation in the.

Similar to how the charts above were calculated if we use a google sheet and enter FV 7 30 0 -10000 in a cell the calculation result will give us exactly 7612255 which represents. Adjust the lump sum payment regular contribution figures. Imagine you start with a 1000 investment and contribute 400month at 10 interest annually.

110 10 1.

Historical Returns Of Different Stock And Bond Portfolio Weightings

Historical Investment Calculator Financial Calculators Com

Inventors And Their Inventions 200 Piece Puzzle Quick Ship In 2022 Inventions Inventor Great Inventions

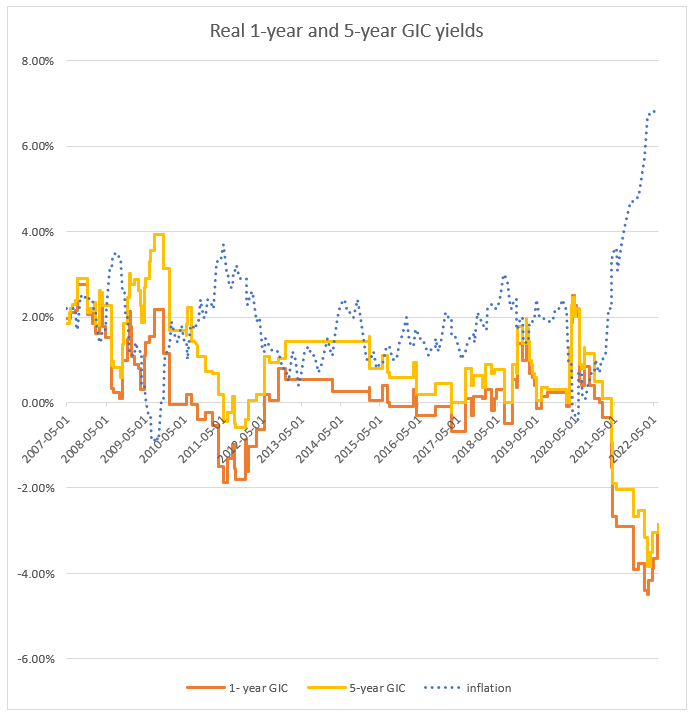

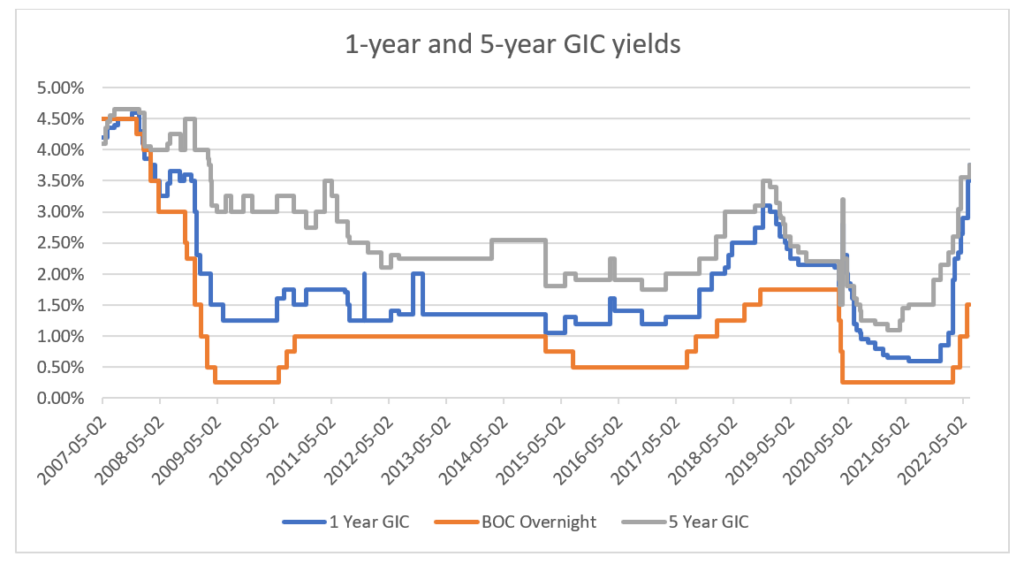

The History Of Gic Rates Ratehub Ca

What Is Considered A Good Return On Investment Sofi

Using Historical Volatility To Gauge Future Risk

Historical Returns Of Different Stock And Bond Portfolio Weightings

Deflation Learn Accounting Accounting And Finance Economics Lessons

Should I Pay Off My Mortgage Or Invest The Money Moneygeek Com

Historical Investment Calculator Financial Calculators Com

Gics What Are They For Pwl Capital

:max_bytes(150000):strip_icc()/download2-44e25c07e2a14b0c90ce2dd0570a5dc3.png)

A History Of The S P 500 Dividend Yield

Historical Returns Of Different Stock And Bond Portfolio Weightings

Ph Log H Assuming 100 Percent Dissociation If Given Percent Ionization Multiply By The Molarity Chemistry Lessons Teaching Chemistry Chemistry Education

Historical Investment Calculator Financial Calculators Com

Apple Inc Aapl Stock 10 Year History

Gics What Are They For Pwl Capital